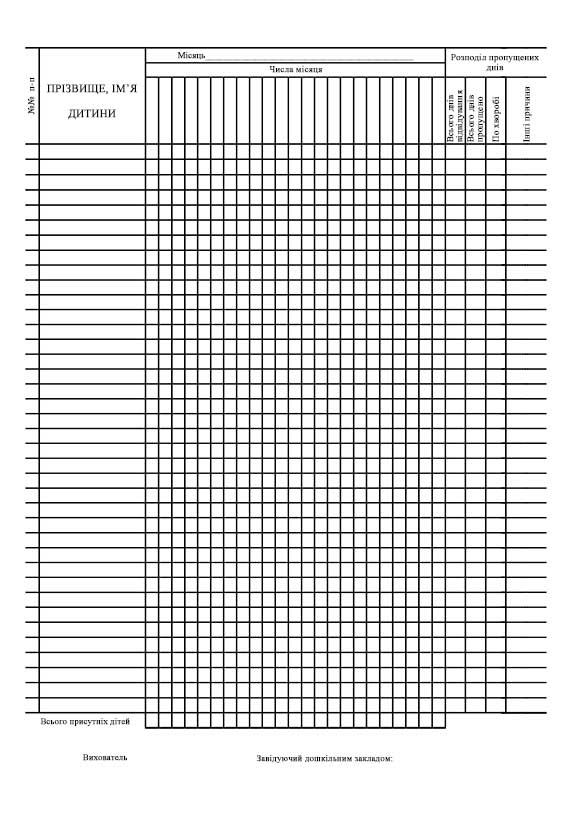

Tabelj Oblku Vdvduvannya Dtej Forma No 305

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act File Number: 811-07749 T. Rowe Price Financial Services Fund, Inc.

(Exact name of registrant as specified in charter) 100 East Pratt Street, Baltimore, MD 21202 (Address of principal executive offices) David Oestreicher 100 East Pratt Street, Baltimore, MD 21202 (Name and address of agent for service). March 31, 2013 T. Rowe Price Financial Services Fund Unaudited The accompanying notes are an integral part of this Portfolio of Investments. Rowe Price Financial Services Fund Unaudited Notes To Portfolio of Investments T.

Rowe Price Financial Services Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks long-term growth of capital and a modest level of income. NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES Basis of Preparation The accompanying Portfolio of Investments was prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the Portfolio of Investments may differ from the values ultimately realized upon sale or maturity. Investment Transactions Investment transactions are accounted for on the trade date.

Keylogger and a good binder for mac. Search the history of over 349 billion web pages on the Internet.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. Dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. Dollars as quoted by a major bank. Purchases and sales of securities are translated into U.S.

Dollars at the prevailing exchange rate on the date of the transaction. New Accounting Guidance In December 2011, the Financial Accounting Standards Board issued amended guidance requiring an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013. Adoption will have no effect on the funds net assets or results of operations. NOTE 2 VALUATION The funds financial instruments are valued and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m.

ET, each day the NYSE is open for business. Fair Value The funds financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Rowe Price Valuation Committee (the Valuation Committee) has been established by the funds Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the funds Board; is chaired by the funds treasurer; and has representation from legal, portfolio management and trading, operations, and risk management.